Debt is a problem.

a big problem.

It’s not your fault. Sadly, most Americans have not been properly educated on how to manage their money. And sometimes no matter how hard or how many times we try to get out of debt, we keep ending up right back to where we started — or worse.

Financial literacy is only taught in a handful of schools. Most of our parents were not properly educated on financial literacy and money management. And we are constantly bombarded with all the ways we can spend our money vs. how to save it and make it work for us.

Unfortunately, things are not getting better… they are getting worse.

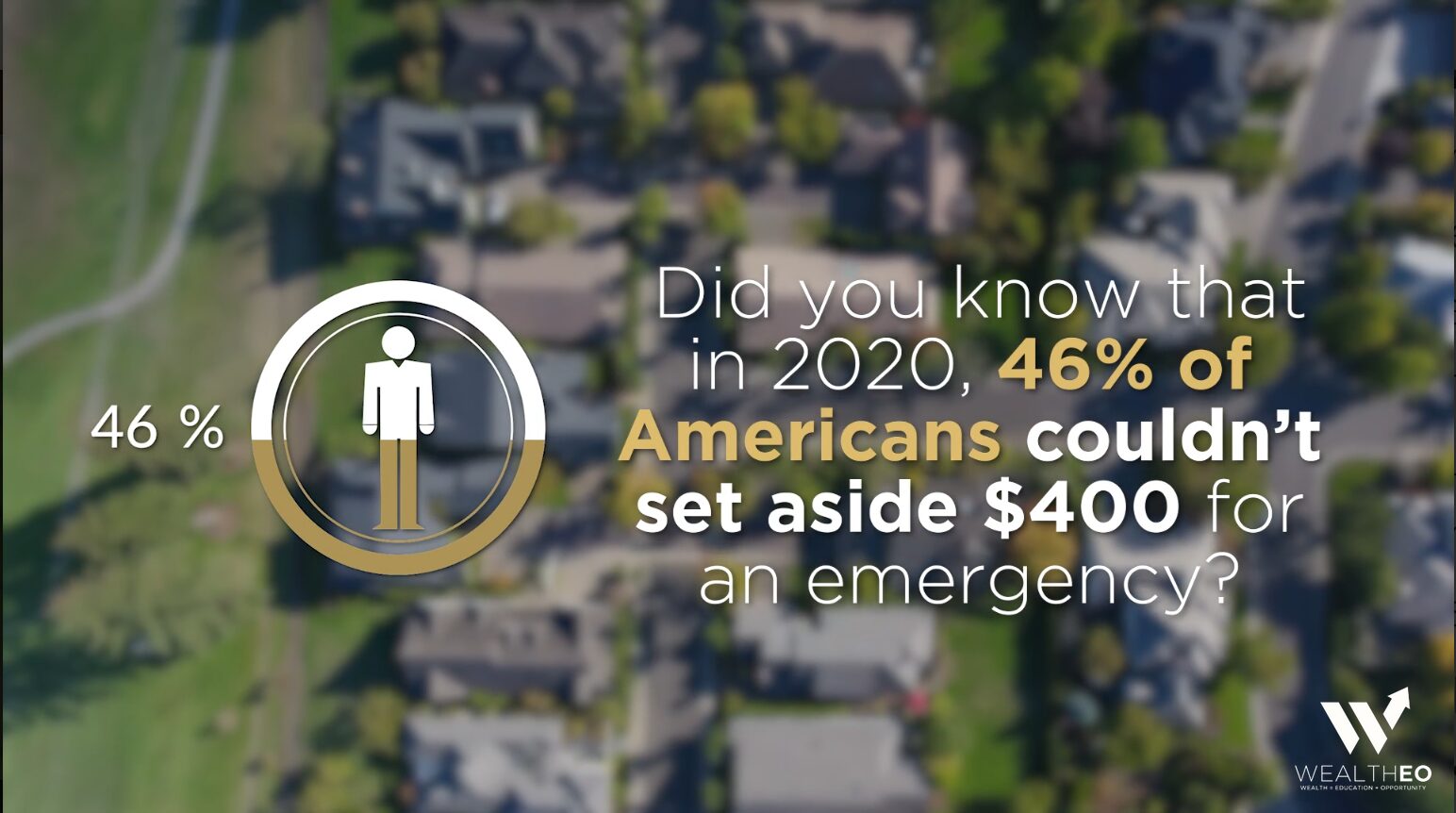

The current state of our Union is troubling…

- 61% of Americans don’t have at least $1,000 in their Savings Account.

- 22% of Americans have less than $5,000 in retirement savings.

- 1 out of 7 retirees live in poverty in the United States.

- 44% of American workers live paycheck to paycheck and are unable to save anything for retirement.

- 52% of Americans actually spend more each month than they earn from their job.

- The average credit card debt is $6,354 per person in the United States.

Thankfully, there is a 100% proven time-tested method to becoming debt-free. The simple method is educating yourself and following the easy steps to not only get out of debt, but learning how to stay out of debt once and for all.

Welcome to Debt Freedom.

WE ARE HERE TO HELP YOU GET OUT OF DEBT.

AND STAY OUT OF DEBT.

By learning the 10 simple steps to becoming free from debt and learning how to achieve financial independence, you can finally break free from the old money habits that have been keeping you stuck.

Do you wish that you had a better understanding of your finances and how money works?

You are not alone.

- Globally, the United States ranks 14th in overall financial literacy. Only 16% of U.S. students are required to take a personal finance class in schools. 60% of Americans claim they need to be more financially secure.

- The sad fact is that getting solid knowledge on the fundamentals of personal finance is hard. The information is either fragmented, contradictory, incomplete, or, in many cases, just plain wrong.

- Lacking easy access to information, many people desperately reach out to predatory credit counseling and debt relief agencies that don't actually solve the real problem - lack of grounding in personal finance fundamentals.

- We can help you because we have been in your shoes. We struggled with debt until we learned the principles we will teach you. So who are we?

Learn more by watching video 1.1 of our Debt Freedom Course below…

We Are Wealtheo

We have decades of entrepreneurial experience and have started and run multiple successful companies. We are backed and led by experts in the personal finance, online learning, and technology professions.

Our mission is to change lives, one family at a time, by providing them with sound financial principles, educational tools to reduce debt and become financially literate.

Through our online education platform, we provide valuable courses and tools to help address the largest problem in personal finance: debt.

We are also committed to providing additional courses and training on how to achieve wealth in all areas of your life.

If you’re ready to finally break the cycle of debt and set you and your family free, our Debt Freedom course is the solution you have been searching for.

Here's how THE DEBT FREEDOM COURSE can help you...

We give you control

We empower you with the information necessary to take control of your debt and finances. We provide you with a roadmap of how to develop a budget, track your expenses, and reduce your debt.

Zero Fluff

This training is all about execution – so we skip past a lot of the theory and dive into actionable lessons. Most videos are no more than 5 minutes long.

More Than Videos

The course is complete with comprehensive online worksheets that will take you through building a budget, tracking your money, paying down your debts, and more.

We're not debt relief

We are not a debt relief service company, we do not contact your debtors to negotiate your debt balances, nor are we a debt counseling agency.

DEBT-FREE IN 10 SIMPLE STEPS

By learning the 10 simple steps to becoming free from debt and learning how to achieve financial independence, you can finally break free from the old money habits that have been keeping you stuck.

The Debt Freedom™ course is a self-paced, online educational financial literacy course that teaches time-proven principles for you to apply, to improve your financial health.

In 21 zero-fluff videos plus 5 actionable worksheets, you will learn…

Module one: Introduction To Debt Freedom

- Exclusive financial literacy test gives you a better idea of where you are now.

- Determine your monthly necessity expenses.

- Determine your monthly discretionary expenses.

- Understanding how personal finance is the managing, saving, and investing of your money.

- How to make a budget allows you to track money coming in and money going out.

- Access to a worksheet to determine your financial goals.

Module two: To Get Out Of Debt You First Need To Understand Debt

- Understanding that financial independence can be achieved at any income level.

- Access to a worksheet to understand your current financial inventory.

- Access to a worksheet to understand your current debt inventory.

- Discover the 10 reasons why people fail financially.

- Understanding your net worth, your assets, and your liabilities.

Module Three: Let’s Destroy Your Debt

- Learn the 10 Debt Freedom steps to financial freedom.

- What to do until your $1000 starter Emergency Fund is funded.

- Understand the importance of tracking every single dollar.

- Learn the purpose of a debt snowball is to create momentum to get debt-free.

- When to use a debt avalanche on top of the snowball to drive debt down quicker.

- Learn what to do with your credit cards once they are paid off.

- Discover a W-4 strategy that could put more money in your pocket, not the IRS.

- The next critical step to take after you funded your Starter Emergency Fund and paid off all your debt.

- Learn about saving for a college fund and what needs to happen before you begin saving.

- Discover the best type of mortgage and how to pay off your mortgage faster.

- Understand the importance of generational wealth and teaching your family these financial principals.

- Plus much more!

WHAT OTHERS ARE SAYING ABOUT THE DEBT FREEDOM COURSE

“The Debt Freedom course was exactly what we needed to finally get on track with our finances. For far too many years we struggled month after month. And now we finally have a plan and not only chipping away at our debt, but we are also saving oney each month. Thank you!

–Paula J. Franklin, NH

“The Debt Freedom course was exactly what we needed to finally get on track with our finances. For far too many years we struggled month after month. And now we finally have a plan and not only chipping away at our debt, but we are also saving oney each month. Thank you!

–Paula J. Franklin, NH

“The Debt Freedom course was exactly what we needed to finally get on track with our finances. For far too many years we struggled month after month. And now we finally have a plan and not only chipping away at our debt, but we are also saving oney each month. Thank you!

–Paula J. Franklin, NH

INVEST IN YOURSELF.

SELF-EDUCATION IS THE KEY TO GETTING IN FULL CONTROL OVER YOUR FINANCES.

- Investing in your own financial education has massive pay-offs that will pay for itself over and over again.

- Most people don't take action and repeat the same patterns that will leave them stuck, never being able to break free from their old money habits.

- Becoming financially literate and fully understanding your finances, debt, and the methods which can set you free financially are not hard. It just takes a willingness to say, "enough is enough" and take action.

- Financial freedom is available to anyone willing to learn a few proven methods and taking action on what they learn.

- The Debt Freedom course was designed to provide you with the foundation you need to build off of now and well into the future.

- The best investment one can make is in themselves. You are worth investing in to build a greater future for yourself and your family.

ENROLL INTO THE DEBT FREEDOM COURSE TODAY.

- Your course includes 21 videos and 5 worksheets all designed to teach you the 10 simple steps to becoming free from debt.

- Packed with information and knowledge you can implement immediately to gain full control over your finances.

- Designed to provide financial literacy education (with zero fluff) along with a complete roadmap to attacking your debt and on the path to financial freedom.

- Get peace of mind knowing you are following a proven system to getting out (and staying out) of debt.

Please check your URL. You may have entered it incorrectly.

Here for the first time?

All of our Consultants, Affiliates, and Customers are referred by our Independent Consultants and Affiliates.

Please get back in touch with the person who referred you to Wealtheo to see if they can assist you with their URL.

ALready have an account?

Please log into your back office and click on the support link. Our support representatives are happy to assist you.

If you forgot your username or password and you are unable to login, please contact us via email at: [email protected]. Thank you.