Does debt have you feeling like there is no escape?

Time’s not up yet. You deserve financial freedom!

$497 $159

Understanding Debt and Wealth Creation Can Accelerate

Your Path To Success.

Did you know that:

Introducing

DEBT-FREE

IN 10 SIMPLE STEPS

by Wealtheo™

21 zero-fluff videos plus 5

actionable worksheets

In this program you’ll discover

- How to remove all patterns that have kept you financially stuck.

- How to fully understand your finances, debt, and the methods which can set you free financially.

- Proven methods for getting rid of debt once and for all.

- How to break free from old money habits to achieve the freedom you deserve.

- The foundation you need to build off of now and well into the future (without this, accumulating wealth is hard).

- And much much more.

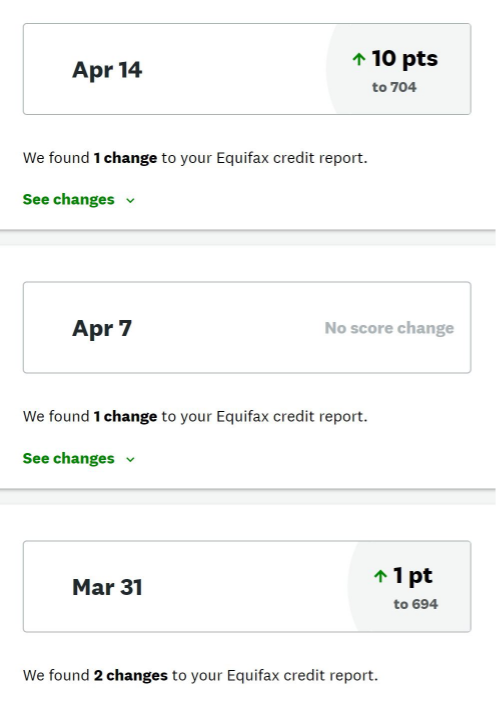

"My credit score has already gone up 10 points..."

"I first took the Debt Freedom course in March of 2021. Like most people in this country, I have credit card debt, and I wanted to start to attack that issue. I took it again in April, just to reinforce the concepts and continue the process. Of course with Wealtheo, you can take your courses over and over again.

The Debt Freedom course gives you actionable steps that you can take to reduce the debt. I started taking these actions for my own situation during March. As a direct result of the Debt Freedom course and the actions that the course suggests and the included worksheets, I am much more aware of my own spending habits and where my money is going, and I am starting to pay down my own debt, and I feel that I am on the right track, and I will continue on that track.

The Debt Freedom course gives you actionable steps that you can take to reduce the debt. I started taking these actions for my own situation during March. As a direct result of the Debt Freedom course and the actions that the course suggests and the included worksheets, I am much more aware of my own spending habits and where my money is going, and I am starting to pay down my own debt, and I feel that I am on the right track, and I will continue on that track.

Tom F. ⭐️⭐️⭐️⭐️⭐️

Get the course that has helped countless people break free from debt.

Get instant access today for only $497 $159.

The Debt Freedom™ course is a self-paced, online educational financial literacy course that teaches time-proven principles for you to apply, to improve your financial health.

Here’s what’s included:

MODULE ONE

Introduction to Debt Freedom

- Exclusive financial literacy test gives you a better idea of where you are now. It’s crucial to understand this to know where you are going.

- Determine your monthly necessity expenses. A quick and simple formula to find out.

- Determine your monthly discretionary expenses, critical for your success.

- Understanding how personal finance is the managing, saving, and investing of your money.

- How to make a budget allows you to track money coming in and money going out. Most people are missing this in their financial life. A simple change, drastic results.

- Access to a simple to use worksheet to determine your financial goals. What you track you can improve.

MODULE TWO

To Get out of Debt You First Need to Understand Debt

- Understanding that financial independence can be achieved at any income level. It’s not how much you make, it’s about what you do with what you make.

- Access to a simple to use worksheet to understand your current financial inventory. You’ll have fun doing this.

- Access to a worksheet to understand your current debt inventory. Once you can see the current picture you can always make it better.

- Understanding your net worth, your assets, and your liabilities.

MODULE THREE

Let's Destroy

Your Debt

- Learn the 10 Debt Freedom steps to financial freedom.

- What to do until your $1000 starter Emergency Fund is funded. Prepare the foundation.

- Understand the importance of tracking every single dollar. We’ll show you simple ways to do it.

- Learn the purpose of a debt snowball is to create momentum to get debt-free. Once you implement this concept, I guarantee you’ll feel better every single day.

- When to use a debt snowflake on top of the snowball to drive debt down quicker than you ever thought possible.

- Learn what to do with your credit cards once they are paid off. The answer might shock you.

- Discover a W-4 strategy that could put more money in your pocket, not the IRS. More for you and your family.

- The next critical step to take after you funded your Starter Emergency Fund and paid off all your debt.

- Learn about saving for a college fund and what needs to happen before you begin saving.

- Discover the best type of mortgage and how to pay off your mortgage faster.

- Understand the importance of generational wealth and teaching your family these financial principals.

- Plus much more!

Get the course that has helped countless people break free from debt.

Get instant access today for only $497 $159.

“I never realized the patterns I had when it came to using credit cards and spending. In using the Debt Freedom course my eyes were finally open to my financial habits in detail, and from a different view. Not only did I not realize how much I was paying in fees, but I was able to raise my credit score almost 30 points in the past couple of months just from starting to pay off the debt I have. Once you learn it, it’s there for you. Don’t wait, the sooner you start, the sooner your financial health grows.”

Tanya ⭐️⭐️⭐️⭐️⭐️